SKU-First Manufacturing SEO: How to Prioritize Product Lines for Fast RFQ Wins

Last Updated: October 18, 2024 • 15 min read

📌 Key Takeaways

Manufacturing traffic means nothing if engineers requesting quotes can't find your exact capabilities when they search with specifications in hand.

- Spec-Based Searches Signal Purchase Intent: Engineers search using precise specifications like "AS9100 titanium machining ±0.0005" rather than generic terms, revealing they have procurement authority and defined requirements.

- Wrong SKU Choices Create Compounding Waste: Optimizing low-margin or operationally constrained products generates unqualified leads that consume sales time while eroding internal confidence in SEO's business impact.

- Pilot with 5–10 High-Margin SKUs: Constraining initial scope to products with strong margins, clear discoverability, and operational readiness proves RFQ impact within 90 days while isolating what actually converts.

- Comprehensive Spec Tables Drive Conversions: Publishing dimensional tolerances, material certifications, and downloadable CAD files directly on product pages answers technical questions without requiring premature contact, qualifying prospects before they submit RFQs.

- Track Micro-Conversions to Predict Pipeline: Monitoring specification downloads, drawing views, and part-match interactions provides leading indicators of qualified interest weeks before formal quote requests materialize.

Focused execution beats broad optimization. Qualified RFQs matter more than traffic volume.

Manufacturing engineers, procurement specialists, and operations leaders evaluating SEO investments will find a proven framework here, preparing them for the detailed SKU selection methodology that follows.

Your website gets traffic. Your analytics show sessions climbing month over month. But your sales team is frustrated; the leads aren't converting, and when they do engage, they're asking questions that suggest they're nowhere near ready to request a quote.

This is the hidden cost of unfocused manufacturing SEO: motion without momentum. When manufacturers cast too wide a net—optimizing for broad category terms or generic "what is" queries—they attract curiosity seekers, not engineers with procurement authority. The result? Marketing celebrates rising traffic while sales struggles with an empty pipeline.

The solution isn't more content or broader keyword targeting. It's ruthless focus on the SKUs that matter most: products with strong margins, clear discoverability in spec-based searches, and operational readiness to fulfill quickly. This article shows you how to identify and prioritize 5-10 SKUs for a tightly scoped SEO pilot that proves RFQ impact within 30 days.

The Problem: Traffic Without RFQs

Most manufacturing SEO strategies fail at the foundation. They optimize for the wrong audience. Generic top-of-funnel content about "precision machining" or "industrial fasteners" attracts readers in research mode, not buyers who know their tolerances, materials, and application requirements.

Engineers and procurement specialists don't search like consumers. When they need a custom CNC-machined component, they don't type "best machine shops." They search for specific capabilities: "AS9100 titanium machining ±0.0005" or "316 stainless steel flanges ASME B16.5." These queries signal purchase intent because they contain the exact specifications needed to evaluate suppliers.

When your SEO targets category-level keywords instead of spec-based, application-specific queries, you create three problems. First, you attract visitors who lack the authority or budget to request quotes. Second, you waste crawl budget on pages that rank but don't convert. Third, your sales team loses confidence in marketing's ability to generate qualified opportunities, creating organizational friction precisely when you need cross-functional alignment.

The disconnect between search intent and content strategy explains why many manufacturers see their traffic grow while RFQ volume stagnates or even declines.

How Wrong SKU Choices Snowball Into Crawl, Content, and Conversion Waste

Selecting the wrong SKUs for SEO optimization creates compounding problems that extend far beyond individual page performance.

Consider faceted navigation, a common feature on manufacturing websites that allow filtering by material, size, finish, and other attributes. While useful for human visitors, poorly implemented facets generate thousands of near-duplicate URLs that consume crawl budget without delivering unique value. When Google's crawlers spend time indexing parameter-heavy URLs like /products/bolts?material=steel&size=m8&finish=zinc instead of your core product pages, your most important content gets discovered and refreshed less frequently.

Spec-poor pages create another failure mode. A product page listing only basic dimensions and a "Request Quote" button fails engineers who need to validate fit before contacting you. Without tolerance ranges, material certifications, surface finish specifications, or technical drawings, these visitors bounce to competitors who provide the evidence needed for technical evaluation. PDF-only spec sheets compound the problem. They're difficult for search engines to index and frustrate mobile users. Pairing each PDF with an HTML companion page carrying equivalent specifications improves both discoverability and user experience.

These technical failures have business consequences. Your sales team fields inquiries from unqualified leads who lack basic understanding of your capabilities. Time spent educating curious researchers is time not spent converting qualified prospects. Meanwhile, your finance team questions the ROI of SEO investments when they see costs rising, but revenue impact remaining flat.

The pattern is predictable: wrong SKU choices lead to weak content, which attracts low-intent traffic, which generates unqualified leads, which erodes internal confidence in the entire SEO program.

The SKU-First Pilot for Fast RFQ Wins

Breaking this cycle requires inverting the traditional approach. Instead of optimizing your full catalog or focusing on high-volume category terms, you deliberately constrain scope to 5-10 carefully selected SKUs that meet specific criteria for discoverability, margin, and operational readiness.

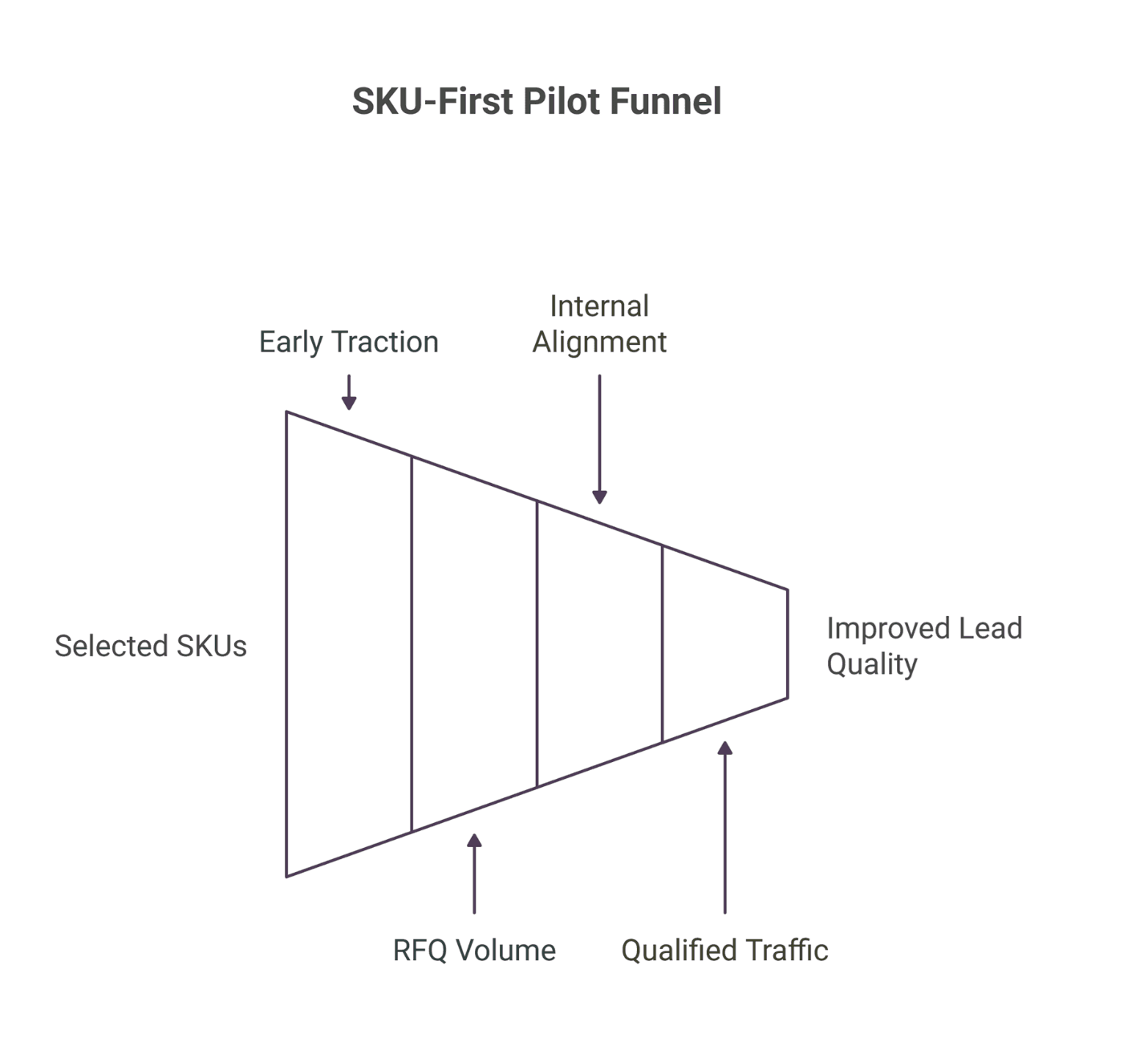

This pilot-first approach serves multiple purposes. It generates early traction indicators—increased impressions, clicks, and on-page engagement—typically within 30 days of launch, with meaningful RFQ volume emerging within 90 days as rankings strengthen and trust signals compound. It isolates signal from noise by limiting the variables that could affect results. It builds internal alignment by demonstrating measurable RFQ impact before requesting budget for broader rollout. Most importantly, it forces you to learn the difference between traffic and qualified traffic in your specific market.

The selection criteria are deliberate. High-margin SKUs ensure that even modest RFQ volume delivers meaningful revenue impact. Discoverability confirms that engineers and procurement specialists are actively searching for these products using identifiable query patterns. Operational readiness guarantees you can fulfill quickly when inquiries convert, preventing negative experiences that undermine future opportunities.

Your content strategy mirrors how technical buyers actually search. Rather than targeting "custom machining services," you optimize for the specific part numbers, material combinations, and application contexts your target customers use: "custom PEEK machining for semiconductor" or "titanium Grade 5 medical implants FDA approved."

This specificity serves dual purposes. It dramatically improves lead quality by attracting visitors with explicit needs that match your capabilities. It also positions you for featured snippets and AI overview citations, which increasingly answer technical queries directly in search results.

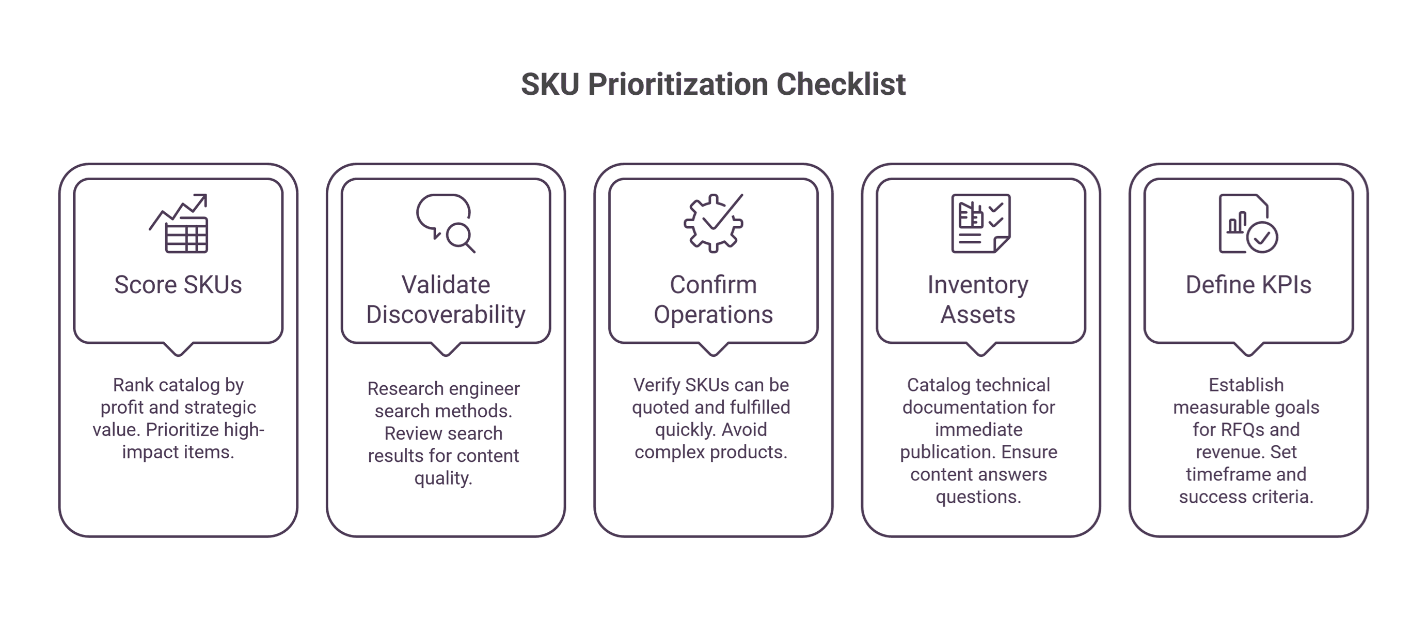

How to Prioritize SKUs: The 5-Step Pilot Checklist

- Score SKUs by margin and strategic importance. Rank your catalog by gross profit per unit and strategic value (customer acquisition, market expansion, or competitive differentiation). Prioritize items where even modest volume increases deliver outsized business impact. Include products that serve as gateway purchases, leading to larger follow-on orders.

- Validate discoverability via spec/application queries and SERP review. Research how engineers search for these products. Do they use part numbers, tolerance callouts, material grades, or application contexts? Use keyword research tools to confirm search volume, then manually review the top 10 results to assess competitive intensity and content quality. Prioritize SKUs where existing results fail to provide comprehensive technical specifications.

- Confirm operations readiness and lead-time feasibility. Verify with your operations team that these SKUs can be quoted and fulfilled within standard lead times. Avoid products with long procurement cycles, complex engineering requirements, or capacity constraints that could create fulfillment issues. The goal is to prove the concept with products you can deliver consistently.

- Inventory proof assets: drawings, spec sheets, tolerances, materials, certifications. Catalog the technical documentation you can publish immediately e.g. CAD drawings, dimensional specifications, material certifications, compliance documentation. Strong pilots require rich content that answers technical questions without requiring prospects to contact you first. If critical assets are missing or outdated, factor creation time into your timeline.

- Define RFQ KPIs, timeframe, and pass/fail criteria; cap pilot scope to 10 SKUs or fewer. Establish specific, measurable goals: number of qualified RFQs, quote-to-close rate, or revenue from pilot SKUs. Set a 30-day measurement window for leading indicators (impressions, clicks, spec downloads) and 90-180 days for meaningful RFQ patterns, recognizing that B2B manufacturing cycles require time to convert search visibility into qualified inquiries. Explicitly define what success looks like and what would constitute failure requiring strategy adjustment.

The 10-SKU cap is deliberate. Smaller scope accelerates learning, reduces implementation complexity, and makes attribution clearer. You can always expand to adjacent SKUs once you've proven the model works.

SKU Prioritization Scorecard

Apply the five-step framework using this evaluation matrix:

| SKU | Margin | Discoverability | Ops Readiness | Proof Assets | Time-to-Value |

|---|---|---|---|---|---|

| Example A | High | Medium | Ready | Drawings + Certs | Short |

| Example B | Medium | High | Ready | Specs only | Medium |

| Example C | High | Low | Limited | PDFs only | Long |

How to use this scorecard: Evaluate each candidate SKU across all five dimensions. SKUs scoring "High" or "Ready" in at least three categories typically make strong pilot candidates. Example A above represents an ideal profile—high margin, operational readiness, complete proof assets, and fast time-to-value offset medium discoverability. Example C, despite high margin, would require significant investment in demand creation and asset development before delivering results.

Execution Patterns That Convert Technical Visits to Inquiries

Technical content alone doesn't generate RFQs. You need deliberate UX patterns that guide engineers from evaluation to inquiry.

Start with comprehensive specification tables that answer the five critical questions every technical buyer asks: What exactly is this product? What are its dimensional tolerances? What materials and finishes are available? What certifications or compliance standards does it meet? What are typical lead times and minimum order quantities?

Make these tables scannable, with clear headers and logical grouping. Include downloadable technical drawings in multiple formats (PDF, DWG, STEP) to serve different CAD systems. Surface this information prominently. Engineers shouldn't need to hunt through marketing copy to find specifications.

Provide multiple, redundant paths to quote requests. A prominent "Request Quote" button in the hero area serves decisive buyers. Part-match forms let visitors specify custom requirements (dimensions, materials, quantities) to check feasibility before formal inquiry. Sample request options lower commitment for prospects who want to validate quality before committing to production volumes.

The effective RFQ path follows a clear progression: Spec table → Part match/compatibility helper → RFQ form. Each step reduces friction while qualifying intent. Engineers who engage with specification tables demonstrate technical interest. Those who use compatibility tools signal they're evaluating fit for a specific application. By the time they reach the RFQ form, they've self-qualified as serious prospects.

Track these micro-conversions in GA4 as leading indicators. Configure events like spec_download, drawing_view, and part_match to capture engagement that predicts RFQ behavior. These events should pass through to your CRM with SKU attribution so sales can prioritize follow-up appropriately.

Embed contextual help through FAQ blocks and internal glossaries that normalize terminology. When you reference "ASME B16.5" or "316L stainless steel," provide brief, inline definitions so prospects don't need to leave your site to understand specifications. This reduces friction and builds confidence that you understand their requirements.

Measurement: From Micro-Conversions to RFQ Disposition

Pilot success requires connecting digital behavior to business outcomes through systematic measurement.

Instrument GA4 to track every meaningful engagement: specification table views, drawing downloads, part-match form submissions, sample requests, and quote submissions. Tag each event with SKU identifiers so you can attribute activity to specific products.

The critical measurement happens post-inquiry: RFQ disposition tracking. Not all quote requests represent qualified opportunities. Work with sales to classify each RFQ by outcome—quoted, declined (out of scope), declined (capacity), won, or lost to competition. This classification reveals which SKUs attract genuinely qualified inquiries versus curiosity seekers.

View results in cohorts, not point-in-time snapshots. A 30-day cohort (all visitors who engaged with pilot SKU pages in a given month) shows immediate traction. Quarterly cohorts reveal compounding effects as improved rankings drive more traffic, which generates more RFQs, which produces testimonials and case studies that further improve conversion rates.

Maintain data hygiene through proper canonicalization and sitemap management. Use canonical tags to consolidate faceted navigation variants to primary product pages. Submit XML sitemaps that clearly indicate priority pages and update frequency. This ensures crawl budget focuses on pages that drive business outcomes.

Connect these metrics to revenue by tagging won opportunities with source attribution. When a quote converts to a purchase order, your CRM should capture that the opportunity originated from organic search on a specific SKU page. This closed-loop attribution proves ROI in terms finance teams understand i.e. not traffic or rankings, but actual margin dollars generated.

Normalizing Technical Terminology

Manufacturing terminology varies widely across regions, industries, and even individual companies. An internal glossary ensures consistency across your content and helps search engines understand relationships between concepts:

| Concept | Common Variants | Normalization Approach |

|---|---|---|

| Part/Component | SKU, Item, Model, Part Number | Use consistent SKU + model naming in titles and specification tables |

| Material | Alloy, Grade, Metal Type | Include material designation + grade in headings and specifications (e.g., "316L Stainless Steel") |

| Tolerance | Precision, Fit, Accuracy | Express tolerance bands consistently (e.g., ±0.01 mm) across all technical documentation |

| Finish | Coating, Plating, Surface Treatment | Specify standard finish names and applicable codes (e.g., "Zinc Plating per ASTM B633") |

| Drawing | CAD, Print, Blueprint, Technical Drawing | Offer both downloadable files and HTML detail views for accessibility |

This normalization serves multiple purposes. It helps search engines recognize that queries for "precision machining" and "tight tolerance machining" seek similar capabilities. It ensures internal site search functions correctly when engineers use different terminology. Most importantly, it reduces friction in the buyer journey by speaking the language your prospects actually use.

What to Scale Next

Successful pilots create the foundation for systematic expansion, but scale requires discipline to maintain quality and attribution clarity.

Begin with neighbor SKUs—products that share materials, tolerance requirements, or application contexts with proven performers. If titanium Grade 5 medical components drove qualified RFQs, expand to other titanium grades or adjacent medical applications before jumping to entirely different product categories. This adjacency strategy leverages existing content assets, internal linking structures, and customer journey insights.

Replicate winning patterns exactly. If specification tables with downloadable CAD files drove engagement for pilot SKUs, implement identical structures for expansion products. If certain schema markup or internal linking patterns correlated with better rankings and conversions, standardize these elements across new pages.

Resist the temptation to rush full-catalog optimization. Maintain focus on products where you can deliver the same level of technical depth and operational excellence that made the pilot successful. Ten deeply optimized, well-supported SKU pages outperform 100 mediocre ones.

Establish quarterly business reviews with sales, operations, and finance stakeholders. Review pilot performance, validate scale decisions against operational capacity, and ensure cross-functional alignment remains strong. This governance prevents SEO from becoming disconnected from business realities.

The goal isn't to optimize your entire catalog. It's to systematically expand your footprint in high-value, high-intent search contexts where you have genuine competitive advantages. Let proof drive scale, not optimism.

Frequently Asked Questions

Disclaimer: SEO timelines and outcomes vary based on competitive intensity, technical implementation quality, and operational execution. The frameworks presented here represent generally accepted practices adapted for manufacturing contexts.

Our Editorial Process: We prioritize accuracy and usefulness. Claims are supported by cited, authoritative sources; guides are reviewed for clarity and applicability to industrial buyers; updates are made as standards and platform guidance evolve.

By BVM Industrial SEO Team — Manufacturing-trained strategists focused on SKU-first demand capture and RFQ growth. 9+ years in business; experience across OEMs, distributors, and complex engineered products. Call Dustin Ogle (979- 272-699) today to discuss your SEO campaign.

[^1]: Google Search Central — Faceted Navigation & Crawl Efficiency

About the Author

Dustin Ogle

Dustin Ogle is the Founder and Head of Strategy at Brazos Valley Marketing. With over 9 years of experience as an SEO agency founder, he specializes in developing the advanced AI-driven strategies required to succeed in the new era of search.